Country report

How Austria's manufacturing industry is fighting for recovery

In the alpine republic, there are many world market leaders and hidden champions. But big successes are currently missing. How can Austria's manufacturing industry grow again despite the crisis? German help and high-tech provide answers.

The Austrian economy is not doing well. According to current forecasts by the OECD and the EU Commission, the Alpine Republic will be the only EU country with an economic decline in 2025. The gross domestic product is expected to shrink by 0.3 percent, after the country was already at the bottom of the EU in 2024 with an economic decline of 1.3 percent.

The triggers were declining investments and stagnant consumption, writes the EU Commission, which also wants to initiate legal proceedings against Austria for excessive new debt. High energy prices and sharply rising production costs have hurt the competitiveness of the industry. This will also burden exports.

After two and a half years of recession and the longest period of weakness since World War II, the Austrian National Bank (OeNB) expects a real increase of 1.2 percent each in 2026 and 2027.

There is hope in the core areas of the Austrian industry, mechanical engineering, and metal production, due to favorable growth prospects in important sales markets. In particular, the infrastructure program and tax investment incentives in Germany are expected to act as a turbo for the export-oriented industry of our southern neighbors. However, the erratic US tariff policy with its uncertain consequences continues to cause concern.

The mood is gloomy at the Association of Metal Technology Industries

Even at one of Austria's largest economic and employer associations, the Association of Metal Technology Industries (MTI), which includes over 1,100 companies from sectors such as mechanical engineering, metal goods, plant engineering, steel construction, and foundries, alarm bells are ringing.

According to a mid-May announcement, the metal technology industry, which in 2024 generated about a quarter of Austria's total industrial production with a production value of around 45.2 billion euros, recorded a production decline of 7.8 percent (after a minus of 8 percent in the previous year). And even in the current year, member companies are not much more optimistic, with an expected further decline of around 3.6 percent.

According to a quick survey among MTI member companies, every second company expects a negative EBIT for the current fiscal year, 46 percent are planning or already implementing relocations, and 43 percent have cut jobs in the last six months. Since 2005, unit labor costs in Austria have risen 27 percent more than in the Eurozone, leading to a sustained loss of competitiveness.

“Despite this rather unpleasant situation, Austria remains one of Germany's most important economic partners,” emphasizes Thomas Gindele, chief executive officer of the German Chamber of Commerce in Austria (DHK). “Although bilateral foreign trade relations also took a hit in 2024, with imports and exports each falling by 5.7 percent, the exchange of goods with the Alpine republic, with a total volume of 128.7 billion euros, still ranks 7th among Germany's trading partners. And in terms of total German exports, Austria still accounts for a remarkable 5 percent with an export value of 77.2 billion euros (2024), almost the same level as Italy and the United Kingdom,” explains the head of the DHK Austria further.

“Austria also plays a significant role in German machinery foreign trade,” adds Georg C. Priesner, head of VDMA Austria. “Although German machinery exports to the Alpine republic fell by another 9.0 percent in 2024 compared to the previous year, to 7,432 million euros, almost 44 percent of Austrian machinery imports still come from the northern neighbor, and Austria continues to rank 8th among the most important sales countries for German machinery.”

Germany also plays an outstanding role for the export of machinery from Austria, accounting for about a quarter of all exports (in 2024 it was 24 percent). “Although machinery deliveries to Germany continued to decline in 2024 and in the first months of 2025, machines made in Austria are increasingly in demand in the USA. In the last five years, they have consolidated their second position with a share of 12.6 percent,” the VDMA expert continues.

German companies are well represented in Austria

“As an export-oriented industrial nation, Austria is an ideal partner and attractive sales market for German companies in many sectors, especially in the fields of mechanical engineering, metal processing, automotive, wood and paper industry, electrical and electronics industry, life sciences, and food industry,” explains Thomas Gindele from the DHK Austria further. “In addition to well-known large companies, the market is characterized by numerous hidden champions and a very high proportion of SMEs. This medium-sized structure and the historical proximity between the two markets provide the ideal basis for bilateral cooperation.”

It is therefore not surprising that numerous German machine builders - often for decades - are present on site. Gindele cites these “showcase companies” as examples:

- The Austrian subsidiary of the German company Trumpf specializes in bending machines and tools. With over 500 employees and a turnover of 207 million euros in the last fiscal year, it is considered by Gindele as a model company for resource and energy-efficient production.

- As part of the German Friedhelm Loh Group, Rittal is a leader in control cabinet and system technology. The Austrian branch with around 115 employees operates locations in Vienna, Linz, Graz, and Lustenau.

- The subsidiary of the German automation specialist Festo is active in Austria not only in sales but also in product and system development. Festo also operates a Technic and Application Center as well as a research unit for industrial control technology.

“Liebherr Austria is also particularly successful with its five production sites (Nenzing, Telfs, Bischofshofen, Lienz, Korneuburg) and about 6,000 employees in Austria,” adds VDMA expert Priesner. “Also, Siemens AG Austria has over 10,000 employees in drive technology, automation, and digitalization in 25 countries, managed from Vienna. Bosch employs 1,000 people in Hallein in a large engine plant.”

In addition, there are several branches of Bosch and Bosch Rexroth. "In the opposite direction, the Andritz AG, the largest Austrian plant manufacturer from Graz, which has 280 branches worldwide, should be mentioned," emphasizes Priesner further. "Andritz AG has over 10,000 employees at many production sites in Germany, including Andritz Schuler."

But there are also - as the DHK in Vienna further reports - less significant players whose commitment in Austria is remarkable. For example, Bekum Maschinenfabrik, headquartered in Berlin, has even completely relocated its European production to Traismauer in Austria. The close cooperation between both locations is based on uniform technical standards and similar legal frameworks. Also worth mentioning is Fraunhofer Austria Research GmbH, which was founded in 2008 as the first European foreign company of the German Fraunhofer-Gesellschaft. 135 employees at the locations in Vienna, Graz, Klagenfurt, and Wattens create application-oriented solutions for business and society.

As particularly successful Austrian machine builders with international networking, Gindele names three companies. "Linsinger Maschinenbau (Steyrermühl, Upper Austria) is a world leader in rail milling trains and special machine construction. The company exports 99% of its products and presented the world's first hydrogen-powered rail milling train in 2020. EMCO GmbH (Hallein, Salzburg), a traditional machine tool manufacturer with around 760 employees, belongs

since 2012 part of the Austrian Kuhn Group and is active internationally, especially in Europe and China. Hirsch Servo AG (Glanegg, Carinthia), originally specialized in EPS packaging, has developed into an international player in machinery and plant engineering. With over 1,900 employees, Hirsch Servo operates 35 production plants in 10 countries.”

These are Austria's strengths

“With its 9.2 million inhabitants, Austria is an industrial and mechanical engineering country,” notes Priesner from the VDMA. “The per capita sales in mechanical engineering are among the highest in the world, just behind Germany. Austria reached the 15th position in the world machinery sales in 2024 - as estimated by the VDMA - with about 33 billion euros, ranking 7th in Europe, just ahead of Switzerland.”

One of Austria's economically outstanding features is - as emphasized by the AHK Austria - its state-of-the-art R&D infrastructure with more than 300 clusters, industrial and technology parks, as well as 2,000 competence, research, and development facilities.

The particular strengths in Austrian mechanical engineering, according to VDMA expert Priesner, lie in education (apprenticeships; higher technical colleges; universities of applied sciences and technical universities), in the high research and development rate (the country ranks third in Europe with 3.4 percent, just behind Sweden and ahead of Germany), in high flexibility, in well-trained specialists, and in the family-run, medium-sized mechanical engineering companies.

"In addition, EU and national funding programs through the Research Promotion Agency (FFG) or the Austria Business Service are boosting Austrian mechanical engineering," Priesner continues. "And in the Austrian Chamber of Commerce, Austrian companies are supported worldwide with over 100 branches in foreign trade (Advantage Austria - foreign trade centers and foreign trade offices)."

This is what Austria's mechanical engineering has to offer

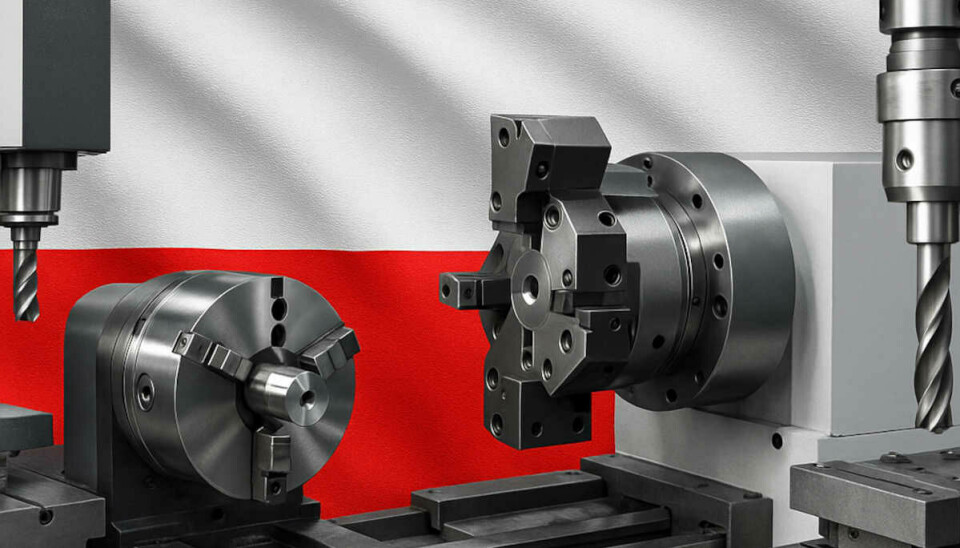

In general, Austrian mechanical engineering has a lot to offer, especially in the fields of conveyor technology, construction machinery, agricultural technology, environmental technology, energy plant construction, plastics processing, and machinery for the paper and packaging industry. Austria has taken a leading role, particularly in the field of machine tools and automation systems.

Companies such as Andritz AG, Engel Austria GmbH, or Palfinger AG are known for their innovative approaches and high-quality products. They also score points with their pioneering role in sustainability and digitalization.

Andritz: Metal industry, energy technology, and more

One of Austria's largest industrial groups, the internationally active Andritz AG (Graz), is a world-leading provider of solutions for pulp and paper production, the metal industry, hydropower plants, as well as the environmental and energy sector. The company, which has 30,000 employees at more than 280 locations in over 80 countries, is driving the green transformation forward with innovative technologies and supporting industries worldwide in increasing their efficiency, reducing waste, and minimizing emissions.

Plants for CO₂ capture as well as for the production of green hydrogen and renewable fuels, biomass boilers, gasifiers, and pumped storage power plants are part of the offering. Other focuses include plants for the production of batteries for e-mobility and textile recycling. With the 'CircleToZero' initiative for the pulp and paper industry, Andritz aims to support its customers in operating plants as waste-free and emission-free as possible.

The new electrolyzer gigafactory in Erfurt also recently made headlines with an initial production capacity of about 1 gigawatt (equivalent to about 160 to 200 electrolyzers per year), which Andritz opened at the site in Thuringia in early June to develop a sustainable hydrogen economy in Europe and as the 'Green Heart of Germany.' The first electrolyzers are intended for a 100-MW hydrogen plant of Salzgitter AG for low-CO₂ steel production. Previously, the Andritz Schuler plant in Erfurt primarily manufactured presses for the automotive industry.

Together with Microsoft, Andritz is also working on the future of the process industry, where fully autonomous factories are to be enabled and a trusted data ecosystem based on the digital platform Andritz Metris and Microsoft Cloud for Manufacturing is to be created.

Engel: Plastic machinery and automation solutions

In the field of plastic machinery manufacturing, Engel Austria GmbH from Schwertberg is a globally leading manufacturer of injection molding machines. The company, with an export rate of 95 percent, is known for its innovative, energy-efficient machines and automation solutions in the plastics sector.

Founded over 75 years ago, the company achieved worldwide sales of 1.5 billion euros in 2024/25, now has nine production plants in Europe, North America, and Asia, as well as branches and representatives in over 85 countries and approximately 7,000 employees worldwide on site.

Palfinger: Crane and lifting solutions

Specialized in cranes, lifting platforms, forestry, and recycling technology, Palfinger AG from Bergheim near Salzburg has established itself. Founded in 1932, the company is a globally leading producer and provider of innovative crane and lifting solutions. In 2024, Palfinger generated total sales of around 2.36 billion euros with 12,350 employees. The company is active in 34 countries and has 30 production sites worldwide.

The topics of sustainability and digitalization have been a priority at Palfinger for years. The company develops systems that reduce fuel consumption and environmental impact. Integrated IoT and cloud technologies in its products enable remote monitoring, maintenance, and control of the systems, improve uptime, and reduce maintenance costs.

Knapp: Digitalization, automation, robotics, and more

Knapp AG, headquartered in Hart bei Graz, also offers state-of-the-art digitalization, software, automation, and robotics solutions. The intelligent automation solutions of the Knapp Group are in demand worldwide, with a list of references that includes the industrial sector, food, wholesale and retail, the fashion industry, and the healthcare sector.

Founded in 1952 as a sole proprietorship with two employees, the company now has a network of 49 locations worldwide with around 8,300 employees and a turnover of 2 billion euros.

Rosenbauer: Firefighting systems and safety solutions

Rosenbauer International AG from Leonding near Linz is the world market leader for firefighting vehicles, firefighting systems, and safety solutions. The company develops low-emission fire trucks and relies on sustainable materials in production. Electric and hybrid vehicles are intended to reduce environmental impact during operations.

Since going public in 1994 and pursuing consistent internationalization, the company has developed from an export-oriented master business to a global corporation and leading supplier of firefighting equipment around the globe.

Innio Jenbacher: Energy technology and hydrogen technology

As a pioneer in the fields of hydrogen technology and renewable gases, Innio Jenbacher is driving forward clean, future-proof energy solutions. The main operational site of the Innio group is located in Jenbach (Tyrol). For more than 65 years, continuous innovations for efficient generation of electricity, heat, and cooling have been created there, which are used in a variety of commercial, industrial, and municipal applications. A focus is on energy generation from renewable sources and waste, combined heat and power plants, or cogeneration plants.

The Jenbacher engines can be operated with a variety of energy sources, ranging from pipeline gas to hydrogen and other renewable gases such as biogas, biomethane, landfill gas, sewage, and synthesis gas. More than 26,000 Jenbacher engines have been delivered to around 100 countries so far.

Edited by Julia Dusold